Founders!! Are we speaking the same language?

Welcome Founders!

I was having a coffee the other day with a Founder and they made an excellent point. If you’re new to the startup space you’ll probably hear a bunch of terms which you may not be familiar with, so there’s a real danger that you’re talking at cross purposes (or you don’t understand the implications of) what they are saying.

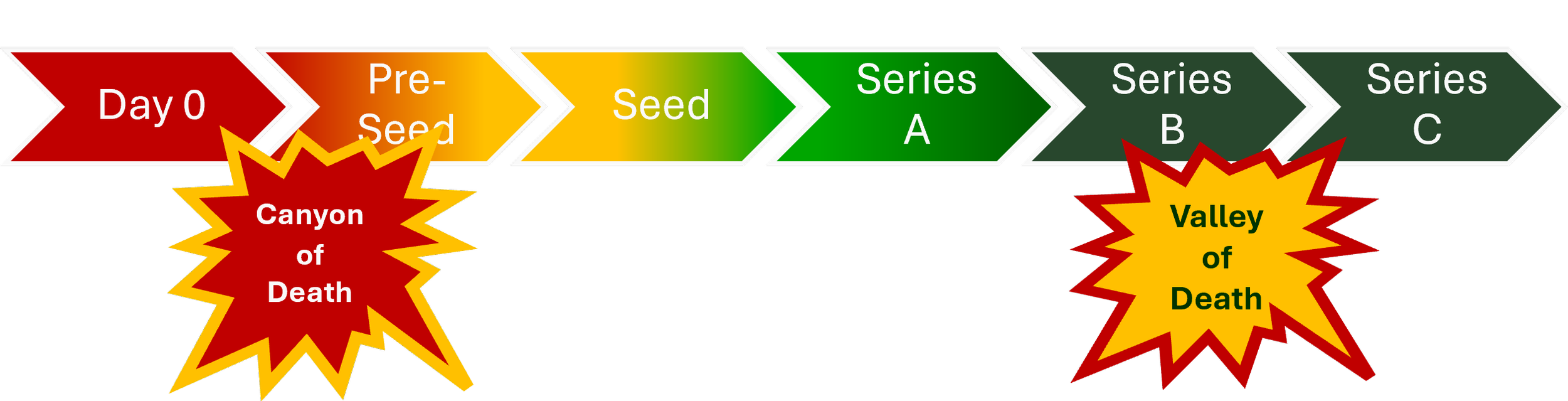

A lot of the terms are related to funding or financing, so let’s start with those. We’ll get to the details, but first, let’s look at the funding flow to get an overview.

Business Funding Flow! (with added emphasis!)

Right, time for some terms! By the way, the meaning of some of these terms changes slightly, particularly in different countries. I’m going to use typically Australian definitions.

Funds Flows

Day 0 - Idea time!

This is the day you decide that you’re going to back your idea and develop it in some form. At this stage, all you have is an idea and enthusiasm. Important phase, as decisions you make here (for example, do I need a co-founder, should I have a company etc) can really help or hinder your business going forward.

Pre-Seed - Idea->Concept

Hypothetically funding to : Validate the business idea, conduct market research and develop an MVP (Minimum Viable Product). I say hypothetically, because often you have to do the business validation and market research before you can get Pre-Seed funding. This seems to be very true if you’re in Western Australia. This requirement to do the business validation and market research before you can get funding leads to the Canyon of Death, especially for ideas requiring significant research or development.

Seed - Early traction

Seed funding helps you refine your MVP, hire your core team, and establish a product/market fit (usually by getting initial sales).

Series A - Scaling the Model

Optimize the business model for profitability, grow the customer base, and prove scalability. Often the first major round led by Venture Capital (VC) firms.

Series B - Growth/Expansion

Scale the company aggressively (e.g., enter new markets, larger team, increase market share).

Series C - Mature / Market Leader

Further massive scaling, preparing for a major exit (like an IPO or acquisition), or making strategic acquisitions. Often includes institutional investors like hedge funds.

Canyon of Death

The inability to get funding to validate your idea or to research whether the idea has a product you can market.

Valley of Death

The inability to get further funding to scale your operations after getting Seed/Series A funding. The positioning of the Valley of Death depends on the type of business, but it is typically because the business isn’t yet showing enough revenue to entice in the larger investors.

Bootstrapping - it’s all on you

Not included in the flow, because this is where you provide all the cash that your business needs. Depending on how much you have (and how much the business needs)

Right, now we have common understanding of the funding flow terms, let’s have some definitions about investors and terms they use.

First, types of investors!

PE - Private Equity.

Refers to firms that invest in or acquire established private companies to improve operations and sell them for a profit, typically focusing on larger, later-stage businesses than VCs.

VC - Venture Capital.

An investor or firm that manages pooled funds to invest in high-growth, early-stage, or scalable technology startups in exchange for a significant equity stake.

Angel (or Business Angel)

A high-net-worth individual who invests their personal capital into early-stage startups, often providing mentorship alongside the money. In Perth there are also syndicates of Angels, like Perth Angels or South West Angels as an example.

Family Office (or FO)

A private company or structure established to manage the wealth and investments of a single wealthy family, often providing patient capital with less rigid return timelines than traditional funds.

Friends, Family, [and Fools] (FF, FFF (or 3Fs))

The reference to Fools is a bit harsh from my perspective. Typically the Fool term refers to the fact that this type of funding is used by very high risk startups (ie-you). Also means the very earliest round of funding, where capital comes from the founders' personal network, often based on trust rather than formal business diligence.

Whew, nearly there for common terms. Actually, I didn’t realise there were so many.

To finish off, some critical terms:

Equity

Equity comprises the capital of your startup, made up of shares (of any type) plus potential shares (from options to buy shares, convertible notes, SAFE etc).

Cap Table

The Capitalisation Table is a list of all your Equity. Simple Cap Tables are generally preferred by investors, that is Startups with no weird potential shares and not too many (definitely less than 50) shareholders.

SAFE

Simple Agreement for Future Equity, essentially where investors give Founders the money up front and then get shares later, usually by reference to the price of a later raising. There are different types of SAFE, with different conditions - these are referred to as Hybrid SAFE. Hybrid SAFE can include the option for the Founder to redeem the SAFE so it doesn’t convert etc etc. WARNING - if you see a SAFE with a Valuation Cap be VERY careful.

Convertible [Loan] Note - CN/CLN

CN are loans, but have an ability to be converted to shares on the repayment date. Depending on the terms, they can be more equity than loan, or vice versa. Again, WARNING - be very careful with these, they can have unexpected traps.

Dilution

The reduction in the ownership percentage of existing shareholders when new shares are issued. Note however, that you can lose significant control over your startup with a small dilution if you aren’t careful about the terms of your investment. This is significantly affected by Valuation Caps if they aren’t carefully set

Valuation Cap - CAREFUL with these

A Valuation Cap is used in SAFE and hybrid Convertible Notes as a mechanism to adjust the return to the investor. Valuation Caps should ALWAYS be estimates of the future value of the Startup, not the estimated value today. Valuation Caps can make a huge difference

The Deck/ Pitch Deck

The presentation used to raise capital. There’s a heap of reading on what to put into a pitch deck, so we’re not going to expand here.

Term Sheet

The non-binding document outlining the basic terms, valuation, and rights of the investment.

Skin in the Game

Refers to the personal capital, time, or risk that founders have personally invested.

Exit

The mechanism proposed to realise value from the startup, for example a sale of the company or a listing on the ASX (IPO - Initial Public Offering). Investors will be keenly interested in the exit!

* * *

Wow, what a list. If you actually made it to the bottom, congrats! If there’s anything you’ve heard that we haven’t covered, feel free to ask in the comments!

Until next time….